STOCKS AND SECURITIES

Advantage of Giving Appreciated Stock Instead of Cash

When you make a charitable gift of cash, you get an income tax charitable deduction only. When you make a charitable gift of the same value with appreciated stock, you get the same income tax charitable deduction and you avoid capital gains tax on all of your capital gain. The more highly appreciated your security, the more capital gains tax you will avoid.

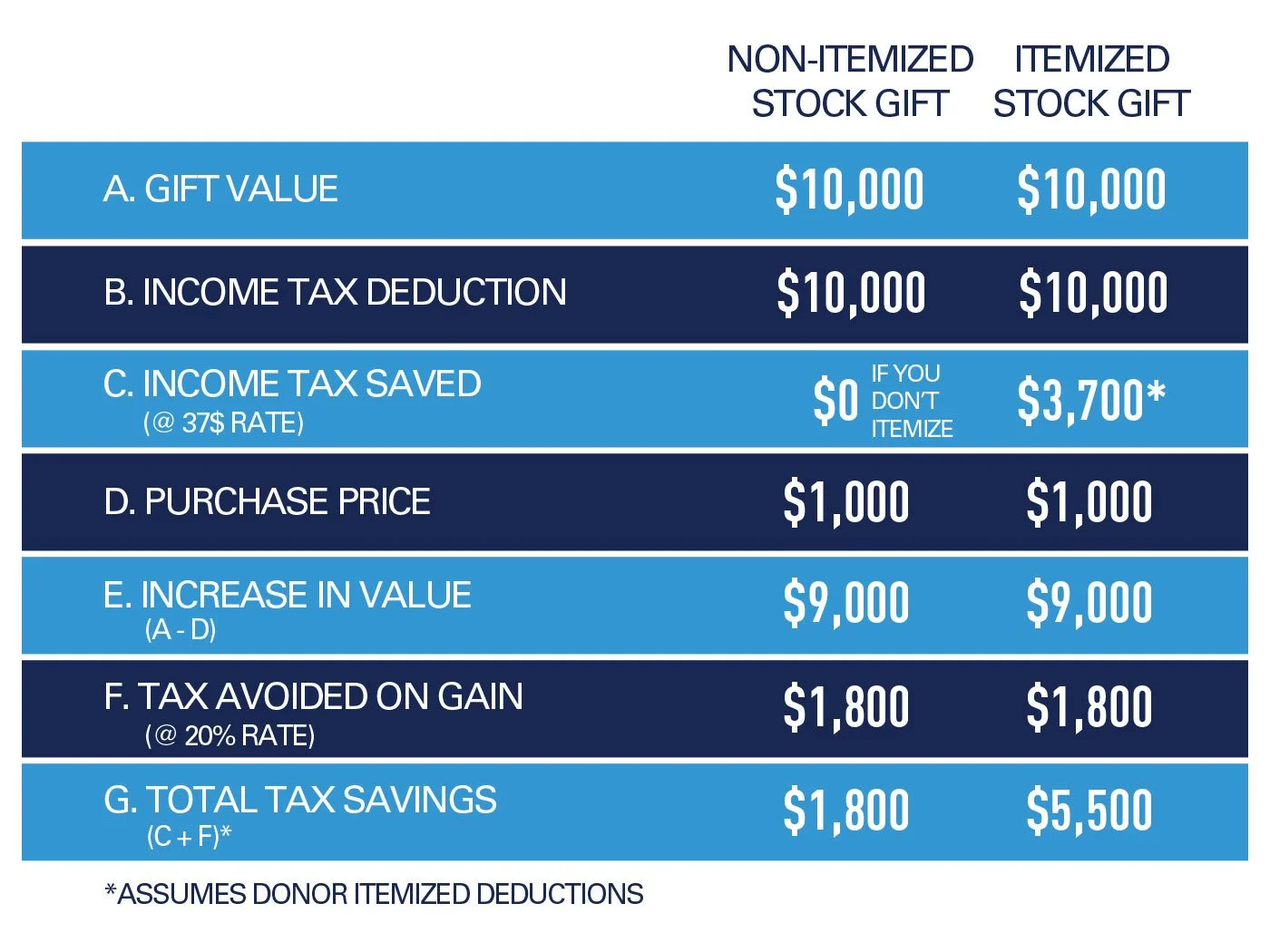

Helpful tip: If you still want to own the shares you are donating you can use the cash you were going to donate to repurchase the same number of shares. Now your new basis will be the higher purchase price without the embedded taxable gain. The chart below shows how making a gift with appreciated stock can save substantially more taxes than making the same size gift with cash.

Example: Itemized Stock Gift vs. Non-itemized Stock Gift

Appreciated Stock

With stock that has appreciated in value, the donor must give the stock directly to the charity to realize these benefits. If the donor sells the stock and subsequently gives the proceeds to the charity, he or she will be responsible for paying a capital gains tax on the profit.

Depreciated Stock

With stock that has depreciated in value (i.e., stock whose value is less than its original cost to the donor), the optimal charitable gift process is reversed. The donor should sell the stock first and then donate the proceeds. This way, the donor can derive the income tax benefit of the capital loss.